Strategic Professional is designed to help you step into senior-level roles with confidence. You’ll develop advanced technical knowledge, strong professional ethics, and the leadership and reporting skills expected of accountants and consultants at this level. You’ll also choose specialist options that align with your career goals. If you’d like to complete all of the Strategic Professional modules, this is available for £4,899 (excluding ACCA subscription and exam costs).

We also offer a price match guarantee on all of our face-to-face classroom delivery modules.

To study the Strategic Professional level, you need to have completed both Applied Knowledge and Applied Skills, or been granted exemptions from one or both of these levels.

Before you apply, it’s a good idea to check your eligibility and any exemptions you may be entitled to on the ACCA website.

Once you’ve completed this level, you’ll be eligible for full ACCA membership and all set to explore the next stage of your accounting career.

This module begins with the legal and regulatory environment, including money laundering, professional ethics, the Code of Ethics, and professional liability. It then covers practice management, focusing on quality management at both the firm and engagement level, as well as the acceptance and retention of professional engagements.

The audit of financial statements is addressed next, including planning, evidence gathering, completion, review, and reporting on historical financial information.

The module finally covers other assignments, such as prospective financial information, due diligence, forensic audits, auditing aspects of insolvency, and reporting. Current issues and developments in audit and assurance services are explored, alongside professional skills that integrate with all areas of the module.

Weekly sessions start on Wednesday 11th March 2026, and run for 12 weeks. Sessions start at 9am and finish at 4pm, with our trainer, Adill Khonat.

Key areas within this module include governance and sustainability systems, focusing on directors’ roles, committee structures, and the scrutiny of senior management performance, under an integrated reporting framework. Once leadership, governance, and sustainability foundations are established, students explore strategy, including assessing the organisation’s strategic position, evaluating options, making decisions, and implementing strategy while managing associated risks.

The module also covers IT and security controls, from strategic applications such as big data, AI, cloud computing, and smart technologies, to operational management, with an emphasis on cybersecurity.

The examination requires candidates to demonstrate the professional skills expected of effective leaders and advisors supporting senior management.

Weekly sessions start on Thursday 19th March 2026, and run for 11 weeks. Sessions start at 9am and finish at 4pm, with our trainer, Adill Khonat.

This module requires students to understand the International Accounting Standards Board (IASB) Conceptual Framework for Financial Reporting and to use it as a basis for applying International Financial Reporting Standards (IFRS) Accounting Standards in corporate reporting.

It covers both the principles and practice of IFRS, focusing on the preparation of financial statements for single entities and groups. Students are expected to evaluate the usefulness of corporate reports to stakeholders, analyse and interpret information, and provide advice on the reporting implications of transactions.

The module then moves on to address developments in corporate reporting, including contemporary issues, their impact on businesses and stakeholders, and the application of IFRS Sustainability Disclosure Standards.

Weekly sessions start on Wednesday 10th June 2026, and run for 11 weeks. Sessions start at 9am and finish at 4pm, with our trainer, Adill Khonat.

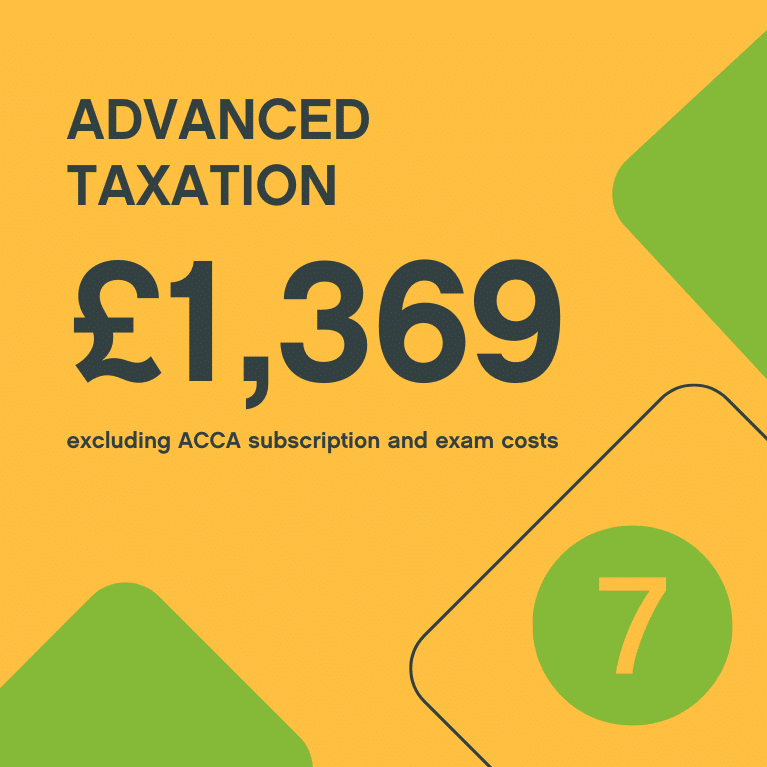

At this level, students are expected to move beyond the purely computational aspects of taxation. While a thorough understanding of calculations remains important, the exam also focuses on developing analytical, interpretative, and communication skills. Students should be able to apply established tax planning methods, consider current issues in taxation, and use computations to support explanations or advice rather than in isolation. Purely calculative questions may still appear, but they are generally integrated into broader scenarios requiring analysis and professional judgement.

Weekly sessions start on Monday 7th September 2026, and run for 12 weeks. Sessions start at 9am and finish at 4pm, with our trainer, Adill Khonat.