Applied Skills builds on what you already know and helps you develop the practical, well-rounded finance skills needed by professional accountants across all sectors. You’ll study key areas such as law, tax, financial reporting, management accounting, and auditing, giving you a strong, broad understanding of how finance works in practice. If you’d like to complete all of the Applied Skills modules, this is available for £6,849 (excluding ACCA subscription and exam costs).

We also offer a price match guarantee on all of our face-to-face classroom delivery modules.

If you’ve completed your AAT Level 4 apprenticeship with EMA or another training provider, the Applied Knowledge level of ACCA, or the ACCA Foundation Diploma, you can start your studies at the Applied Skills level.

Before applying, we recommend you check your eligibility and any exemptions you may be entitled to on the ACCA website.

Once you’ve completed this level, you’ll be ready to progress to Strategic Professional.

Corporate and Business Law is structured into eight key areas.

The module begins with an overview of the English legal system, including the court structure and sources of law. It then progresses to the law of obligations, focusing on contract and tort law, which form the foundation of business transactions.

Students will also explore a range of legal topics that are particularly relevant to finance professionals. These include employment law and company law, covering areas such as the formation and constitution of companies, methods of financing and types of capital, day-to-day management, administration and regulation, as well as the legal aspects of insolvency.

Weekly sessions start on Monday 9th March 2026, and run for 9 weeks. Sessions start at 9am and finish at 4pm, with our trainer, Adill Khonat.

This module develops the knowledge and skills expected of a finance manager responsible for a business’s finance function. It begins by introducing the role and purpose of financial management and the economic environment in which financial decisions are made. The module then explores the three core financial management decisions: investment, financing, and dividend policy.

Investment decisions cover both working capital management and the appraisal of long-term investments. Financing decisions focus on sources of business finance, dividend policy, and the cost of capital. The unit also examines business and asset valuation, before concluding with an introduction to financial risk and key risk management techniques.

Weekly sessions start on Monday 8th June 2026, and run for 11 weeks. Sessions start at 9am and finish at 4pm, with our trainer, Adill Khonat.

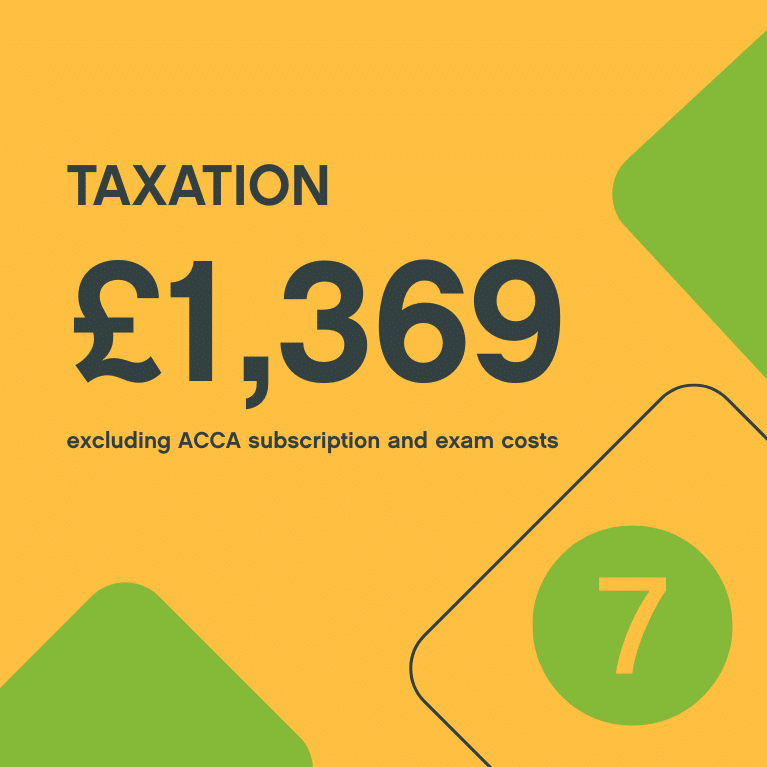

This module introduces students to the purpose and functions of the tax system, before examining the key taxes that accountants need to understand in detail. These include income tax on employment, self-employment and investments; corporation tax for individual companies and groups; national insurance contributions for employed and self-employed individuals; value added tax for businesses; capital gains tax on disposals by individuals and companies; and inheritance tax on lifetime transfers and on death.

By the end of the module, students will be able to calculate tax liabilities, explain their computations, apply basic tax planning techniques, and identify key compliance requirements across a range of personal and business scenarios.

Weekly sessions start on Monday 7th September 2026, and run for 11 weeks. Sessions start at 9am and finish at 4pm, with our trainer, Adill Khonat.

This module begins by exploring the use and control of information, management information systems, and data analytics, which are essential for organisations to measure and manage performance in today’s competitive environment. It highlights how technology and information systems influence management accounting techniques and support organisational control.

It then introduces more specialised costing and management accounting topics, building on knowledge from Management Accounting, particularly in overhead treatments. The focus extends to decision-making, including challenges related to scarce resources, pricing, and make-or-buy decisions, and how these impact performance assessment. Students also develop an understanding of risk and uncertainty, applying basic techniques to manage the risks inherent in real-world decision-making.

Module start dates commencing March 2027.

This module begins with the Conceptual Framework for Financial Reporting, focusing on the qualitative characteristics of useful information and the fundamental accounting principles.

It then moves on to examine the regulatory framework and its role in informing the standard-setting process. Key areas include the preparation and reporting of financial information for both single companies and groups, in line with generally accepted accounting principles and relevant International Financial Reporting Standards (IFRS).

The module finally covers the analysis and interpretation of financial statements, incorporating both financial and non-financial information to support informed decision-making.

Module start dates commencing June 2027.

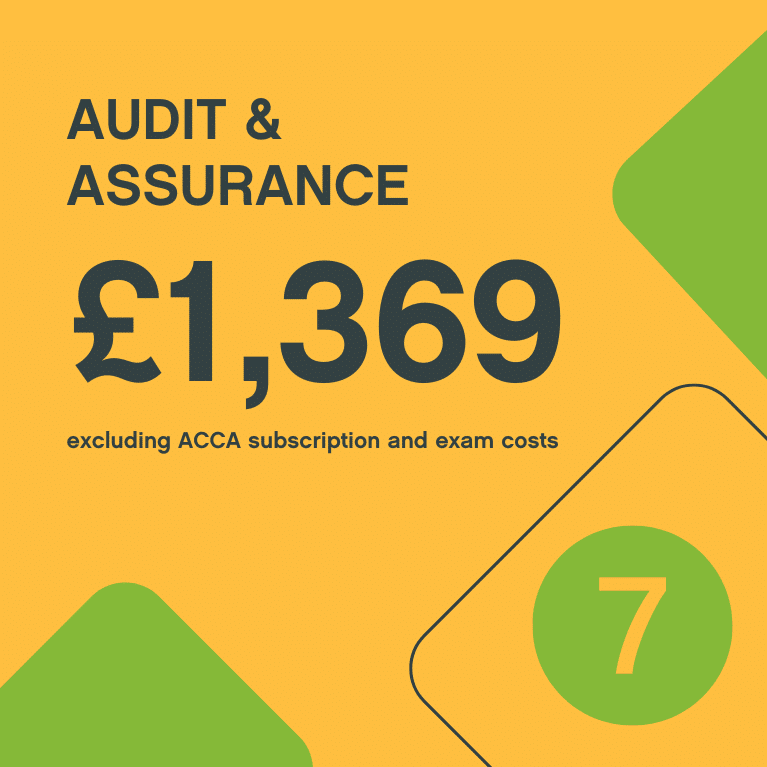

This module begins by introducing the nature, purpose, and scope of assurance engagements, including statutory audits, their regulatory framework, and the related governance and professional ethics. It then covers audit planning and risk assessment.

Students explore the audit of financial statements, including internal controls and the role of internal audit, evaluation of audit evidence, and review of the financial statements.

The module concludes with final review procedures and focuses on reporting, including the form and content of the independent auditor’s report.

Module start dates commencing December 2026.